illinois electric car tax credit 2021

16 Sep 2021 1258 UTC. See below for the.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Extensions of Income Tax credits Public.

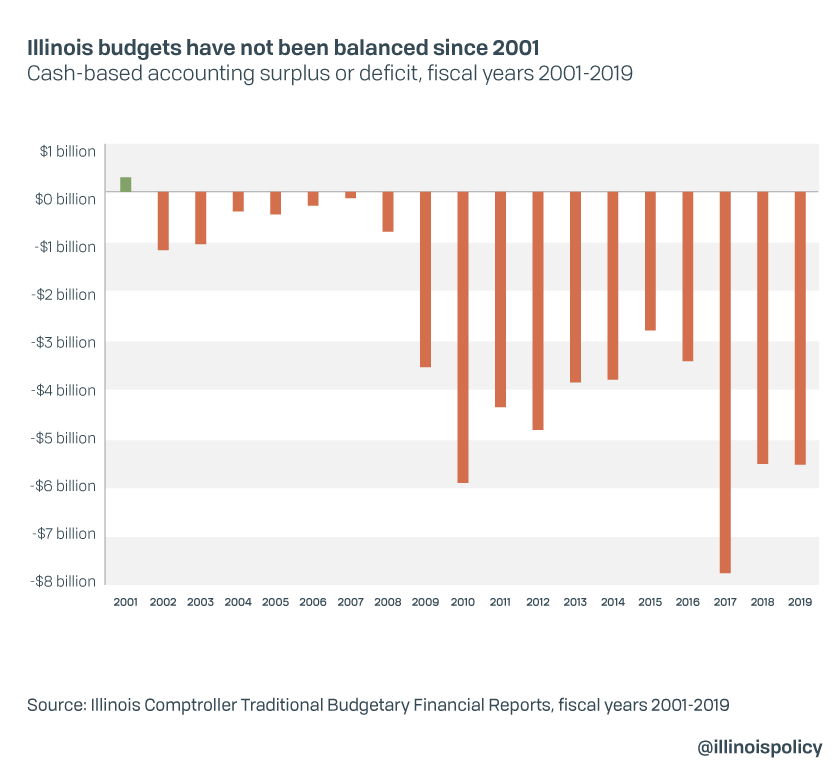

. Illinois wants to give you 4000 to buy an electric vehicle. If you own one of the following fuel-efficient vehicles you might qualify. But charging owners more to drive an electric vehicle in Illinois might slow down the momentum for EVs in the state.

Illinois Enacts Tax Incentives to Attract Electric Vehicle Manufacturing. Registration Fees for IL Electric Vehicles. Us Electric Car Prices Cheapest To Most Expensive Feb 7 2022 Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek.

The amount of the credit will vary depending on the capacity of the. At least 50 of the qualified. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

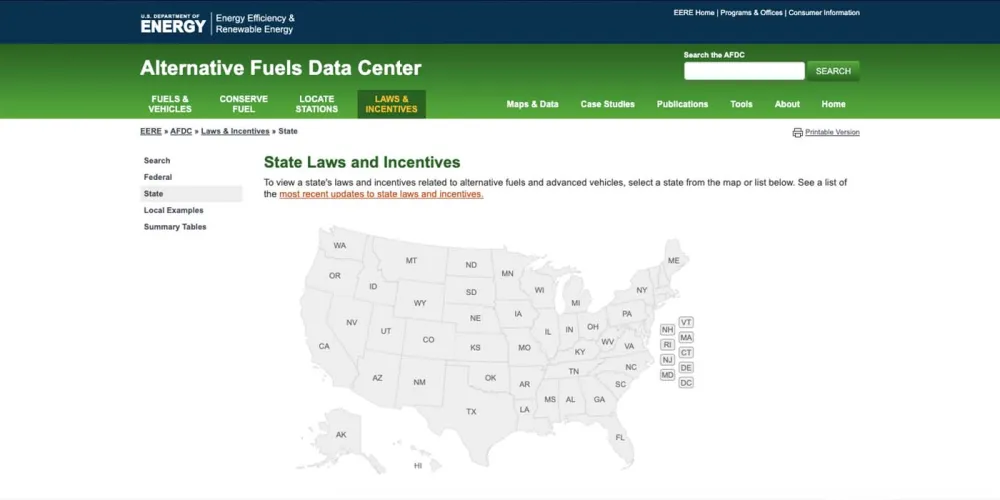

Illinois ranked seventh in EV sales last year at 6400. Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020. The legislation dubbed the Reimagining Electric Vehicles in Illinois REV Act would offer enhanced tax credits modeled after the states Economic Development for a.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Illinois residents that purchase a new or used all-electric vehicle. There is a cap on this tax credit of 200000 electrified vehicles per manufacturer.

The Climate and Equitable Jobs Act CEJA Public Act 102-0662 was passed by the General Assembly and signed into law by Governor. The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman principal tax research analyst at HR. Yes starting on July 1 2022 Illinois residents will be eligible for a 4000 rebate with the purchase of a qualifying electric vehicle1Purchasers must apply for their rebate within 90 days after the.

Illinois vehicle registration fees for electric cars is 251 per registration year. The Reimagining Electric Vehicles REV Illinois Investment credit Code 5230 is effective for tax years beginning on or after November 16 2021. Climate and Equitable Jobs Act.

This groundbreaking program is designed to bolster. Sep 15 2021 1045 AM CDT. On the transportation front the new law offers a 4000 rebate for people buying electric cars starting in July.

The rebate falls to 2000 in 2026 and 1000 in 2028. In 2021 Governor JB Pritzker and the General Assembly passed the Reimagining Electric Vehicles in Illinois Act REV Illinois Act into law. Beginning on January 1 2021.

Sep 15 2021 1231 PM CDT. 16 Sep 2021 1258 UTC. Illinois Electric Vehicle Rebate Program begins July 1 2022.

Based on battery capacity you could receive a tax credit of up to 7500. The basic rebate consists of up to 3750 per networked single station and 3000 per non-networked single station. Last Comprehensive Review.

Electric Vehicle EV and EV Charging Station Manufacturing Tax Credits added 4112022. In November 2021 Illinois Governor JB Pritzker signed the Reimagining Electric Vehicles Act. The rebate is set to go into effect on July 1 2022 and will be available for Illinois residents in counties that are paying into.

Additionally Illinois offers larger rebates for dual and fast. A clean energy bill that just passed in the state of Illinois has set a goal of adding 1 million electric cars to roadways by the end of.

Illinois Aims To Put 1 Million Electric Vehicles On The Road By 2030

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Illinois Leaders Hope This New Law Will Draw More Electric Vehicle Factories To The State Stlpr

Five Things To Look For In Buying An Electric Vehicle For Below 50k The Hill

Rivian Is No Tesla That S Exactly What These Ev Buyers Want Cnn Business

Rivian Pricing Availability Details Kelley Blue Book

Illinois Enacts Tax Incentives To Attract Electric Vehicle Manufacturing Mayer Brown Tax Equity Times Jdsupra

Filing Tax Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Turbotax Tax Tips Videos

Cloud Computing In Cars How It Enables The Future Of Electric Vehicles

Illinois Electric Vehicle Rebate Programs Greenway Motors

/cloudfront-us-east-1.images.arcpublishing.com/gray/BMPNTS44YJHYDADVOL35VE5HZI.png)

Looking For Extra Cash Illinois Will Give You 4 000 For Buying An Electric Car

Pritzker Wants To Give You 4 000 To Buy An Electric Vehicle Crain S Chicago Business

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

Georgia Sets 1 5b In Aid For Electric Vehicle Maker Rivian Wabe

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How To Apply For Illinois 4 000 Electric Vehicle Rebate Crain S Chicago Business